Greater Portland Industrial Real Estate Market Update – 2022

By Justin Lamontagne, CCIM, SIOR, Partner | Designated Broker, The Dunham Group

On January 20th Justin presented the “Greater Portland Industrial Market Forecast” at the Maine Real Estate & Development Association’s (MEREDA’s) 2022 Annual Forecast Conference. Below is a modified version of The Dunham Group’s Market Survey.

After the roller coaster that was 2020 (remember the Great Pause of March/April 2020?!), we settled into a more traditional industrial sector experience in 2021. That is to say, it was nuts. Our decade run of increasing demand and decreasing supply continued and we see no signs of material change in the coming year.

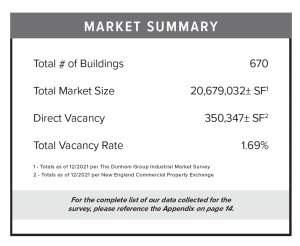

All of our economic indicators including lease rates, sale pricing, cap rates, and overall inventory counts reflect as competitive and challenging a market as we’ve ever experienced. Overall vacancy rates fell sharply from last year’s 2.44% to today’s stifling 1.69%, and that is with a nearly 500,000 SF increase in supply! Even with two additional speculative construction projects in the pipeline, my sense is we’ll be working in a sub-2% vacancy environment for most of 2021. That, of course, is an inhibiting number for tenants and buyers, particularly small-medium sized companies in the 5-10k SF range.

The aforementioned increase in supply is largely due to the unprecedented success of the Innovation District at the Downs. About a dozen buildings were added, mostly by end-users. But a handful were speculative leasing projects that were fully rented by the end of this year. The land cost a premium as compared to raw, undeveloped sites ($300k/acre vs. $100k+-). But buyers had a much simpler and clearer path to getting shovels in the ground. It’s a model that is sure to be replicated in other parts of Southern Maine.

Of course, not every business can build new. The vast majority of our transactions are for existing sites and, most challenging, several were lease renewals. The last couple years has reinforced the importance of having strong lease renewal language in how to define “market rates”. It’s a delicate balance. We navigated several deals where Landlord’s want all the money but need to consider the benefits of keeping a good tenant versus testing the market for a new one. And, importantly, we’re starting to get to a point where businesses simply can’t afford what the market may bare. So difficult decisions are being made across the board and there are certainly winners and losers.

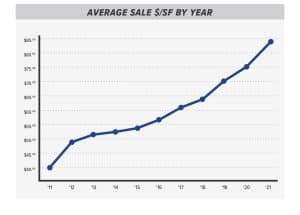

I continue to be amazed at the fiercely competitive and ever rising sales market. Virtually every industrial sale in 2021 set a record for its area. As with lease pricing, brokers are setting the market on each sale. We try to set value based on data and buyer appetite (not to mention appraisers) for increasing costs. But, truthfully, there is a sense of throwing darts when it comes to setting asking prices right now. Overall, we are now averaging over $85/sf, but that’s statistically deflated due to some larger SF sales. Anything under 20,000 SF is now comfortably over $100/sf. And premium sales are much higher, particularly those buildings that are cannabis-appropriate. That industry seems to have no budget. These are staggering numbers, nearing full replacement costs.

An interesting byproduct of all of this activity is the impact on the industrial capital markets. As you’d expect the product has never been hotter. We are now regularly seeing 7% cap rates for well-located Class-A & B facilities, and some cases even lower. And investor-appetite for risk continues to increase with shorter lease commitments, shakier tenants and expanding geographics. These deals are often precipitated by 1031-Exchange and cash buyers driving competition. Banks and appraisers are starting to catch up and underwriting problems have seemed to have eased. I don’t think there’s any doubt that financial institutions feel as comfortable with industrial real estate as they do with housing and multi-families. With larger, institutional competition discovering our market, many smaller, local investors are on the sidelines. But opportunities remain for those who are well plugged into the market. A number of the more successful investment sales of the year were off-market, local deals and that trend is likely to continue into 2022.

Perhaps the only thing I can see impeding the industrial sectors continued growth: the economy. Industrial businesses are not immune to things like inflation, or shrinking labor pools, or supply chain issues or any of the other scary things beyond our control. That said, even with the specter of a worsening economy, I think it unlikely our local industrial market will take much of a hit. The local conditions and indicators are simply too strong for any major negative swings into 2022.

The Dunham Group’s annual study and inventory of the industrial real estate market is now available!