Articles and Editorials

Recent Articles

In Maine, Evolution Drives Economic Prosperity

By: James W. Dinkle, Executive Director, FirstPark Maine’s economy is strong, and the proof is in the proverbial pudding. In fact, our state economy is one of the strongest in...

Read ArticleBad for Business…

By: Justin Lamontagne, CCIM, SIOR, Partner | Designated Broker, The Dunham Group The year was 2011, and a young, ambitious broker received a lead on a 30,000 SF industrial tenant...

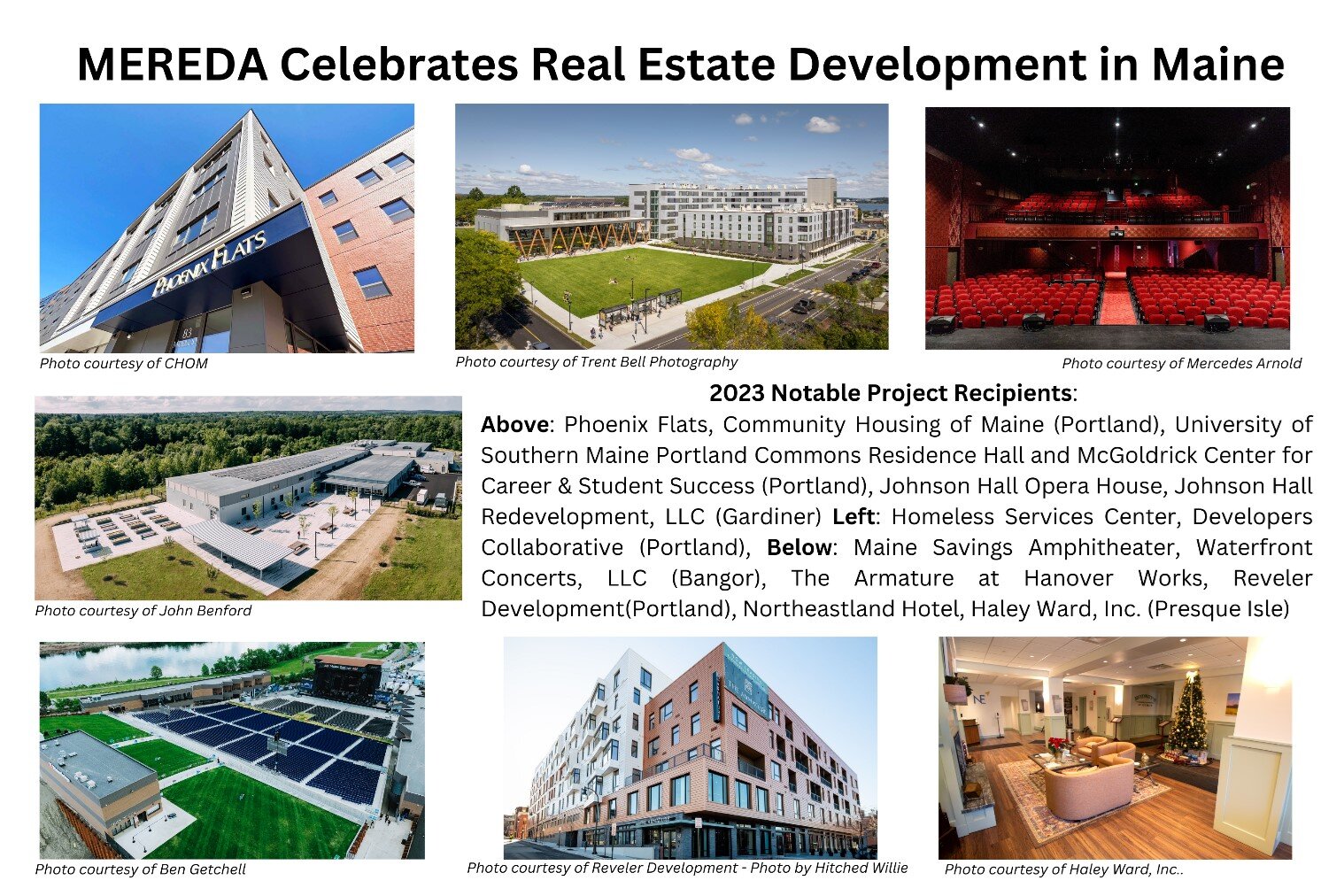

Read ArticleMaine Real Estate & Development Association Recognizes Top 7 Notable Projects of 2023

The Maine Real Estate & Development Association (MEREDA), the state’s leading organization promoting responsible real estate development, honored projects from Portland to Bangor to Presque Isle, with each receiving special...

Read ArticleArchive

Unveiling the Transformative Power of AI in the Modern Workplace

By: Stephanie Brock, RED THREAD, VP & GM Maine In today’s fast-paced digital landscape, Artificial Intelligence (AI) adoption isn’t just reshaping workplace dynamics; it’s ushering in a new era of...

Read ArticleIn Maine, Evolution Drives Economic Prosperity

By: James W. Dinkle, Executive Director, FirstPark Maine’s economy is strong, and the proof is in the proverbial pudding. In fact, our state economy is one of the strongest in...

Read ArticleBad for Business…

By: Justin Lamontagne, CCIM, SIOR, Partner | Designated Broker, The Dunham Group The year was 2011, and a young, ambitious broker received a lead on a 30,000 SF industrial tenant...

Read ArticleMaine Real Estate & Development Association Recognizes Top 7 Notable Projects of 2023

The Maine Real Estate & Development Association (MEREDA), the state’s leading organization promoting responsible real estate development, honored projects from Portland to Bangor to Presque Isle, with each receiving special...

Read ArticleThe Greater Portland Retail Forecast for 2024

On February 29th, 2024, Peter Harrington of Malone Commercial Brokers presented “The Greater Portland retail forecast for 2024” at the Maine Real Estate & Development Association’s (MEREDA’s) 2024 Annual Forecast...

Read ArticleMaximizing energy tax credits for RE developers

By Anita S. Mahamed, Dannielle Lewis, Teri Samples | Partners at Wipfli The real estate industry can greatly benefit from energy tax credits and the changes made in the Inflation...

Read ArticleMaine’s Housing Shortage Conundrum

By John Finegan | Associate Broker, The Boulos Company Like many states across the country, Maine has a housing crisis. The ripple effects of COVID and the needs of asylum...

Read ArticleThe 2023 Maine Capital Markets Outlook

By Chris Paszyc, CCIM, SIOR | The Boulos Company – Partner, Broker 2022 was the tale of two halves. I harken back to the 2017 Superbowl where the Patriots were...

Read ArticleThe Outstanding Seven: MEREDA’s 2019 Notable Project Recipients

PORTLAND, ME – July 13, 2020 – Every spring, MEREDA recognizes the most noteworthy and significant Maine commercial development projects from the previous year, all of which embody the Association’s mission...

Read ArticleMaine Issues COVID-19 Guidance for Town Meetings

Throughout the pandemic, MEREDA members have navigated participating in various town public proceedings conducted virtually. Now, with the opening of municipal buildings and the need to accommodate municipal matters requiring...

Read ArticleThe 2020 MEREDA Index: A Look at the 2019 Data and a Review of Current Conditions

On Thursday, June 4th, MEREDA unveiled its 2020 MEREDA Index, at a free-to-attend virtual event to discuss the 2019 data, and apply that knowledge to today’s constantly-shifting landscape and unpredictable future. ...

Read ArticleConstruction Businesses: Navigating State and Federal COVID-19 Workplace Safety Requirements

On April 28, Governor Mills released Restarting Maine’s Economy, which lays out a plan for re-opening non-essential businesses. Businesses that were previously deemed essential, including construction businesses, may continue operations...

Read ArticlePandemic Leaves Landlords in a Difficult Position

by: Gary D. Vogel, Attorney, Drummond Woodsum, MEREDA President The coronavirus pandemic is affecting everyone. Many businesses are shut down, or are minimally operating. The CARES Act recently adopted by...

Read ArticleGovernor Mills issues Executive Order lifting in–person requirements for certain notarial acts and acknowledgements

On Wednesday, April 8, 2020, Governor Mills issued Executive Order 37 (EO 37), An Order Temporarily Modifying Certain In-Person Notarizations and Acknowledgement Requirements. This order relaxes certain legal requirements that...

Read ArticleMaine Home Prices – Where do we go from here?

by: Dava Davin, Principal, Portside Real Estate Group When I presented at the 2020 MEREDA Real Estate Forecast Conference in January, I was full of good news and positivity in...

Read ArticleMessage from MEREDA’s President

To our Members: What a challenging time we find ourselves in! First and foremost, I hope this email finds you, your family, loved ones and coworkers safe and healthy. We...

Read ArticleSuccessful CEO’s Look Back to Prepare Forward

by George E Casey Jr., Chief Executive Officer, Stockbridge Associates, LLC General Patton said he hated paying for the same real estate twice. You should feel the same about paying...

Read ArticleVital Ideas – The 1031 Dominoes

by Brit Vitalius, Principal, Designated Broker, Vitalius Real Estate Group In 2019, we saw 1031 exchanges used even more frequently than in past years. Interestingly, the variations in the transactions...

Read ArticleInsider Notebook: Affordable housing initiative gets Mills boost

One of the louder and longer periods of sustained applause at Gov. Janet Mills’ state of the state address Tuesday night was when she called for more affordable housing support....

Read ArticleMEREDA 2020 forecasters see another strong real estate year for Maine

Despite snow across the state, more than 900 real estate brokers, developers and others in the industry attended Thursday’s Maine Real Estate and Development Association 2020 Forecast and Conference. That...

Read ArticleMaine real estate experts meet for annual conference

Thursday, real estate experts and business leaders from around Maine gathered for the annual forecast conference put on by the Maine Real Estate and Development Association. Click the Link Below...

Read ArticleBooming real estate market challenges businesses, home buyers

Southern Maine’s superheated real estate market is presenting challenges to first-time home buyers and businesses that are trying to expand, and it shows no signs of cooling off. Click the...

Read ArticleWorkforce Shortage Among Factors Affecting Maine’s Real Estate Market, Says Trade Group Head

Maine, like the nation, has now seen economic growth that’s gone on unbroken for over a decade. That growth has been reflected in real estate development around the state. Will...

Read ArticleMEREDA Celebrates 35 Years of Supporting Responsible Development in Maine!

Yes, it’s true, 2020 is MEREDA’s 35th Anniversary and we are proud to celebrate 35 years of service to our industry and our state! To mark this occasion, we are holding a...

Read ArticleMaine’s real estate market: low inventory, high demand

In the latest report from the Maine Real Estate and Development Association, analysts say commercial real estate activity is cooling off, but residential is holding strong.

Read ArticleSpring 2019 MEREDA Index Commentary – THE CONSTRUCTION COMPONENT – Richard Brescia, Cianbro

In late 2018 and early 2019, Cianbro continued to see strong construction demand, including increased interest and investment from sources outside of Maine. What’s more, the demand wasn’t concentrated in...

Read ArticleReal estate trends point to a cooling economy, experts say

Experts at a Maine Real Estate and Development Association conference say the economic cycle that brought years of real estate market growth appears to be winding down.

Read ArticleSpring 2019 MEREDA Index Commentary – THE RESIDENTIAL COMPONENT – Elise Kiely, Esq., Legacy Properties Sotheby’s International Realty

Elise Kiely, Senior Vice President , Legacy Properties Sotheby’s International Realty recently provided insight for the Spring 2019 Edition of the MEREDA Index by sharing her perspective on the Residential...

Read ArticleCommercial real estate activity declines in Maine amid residential gains

Lackluster commercial real estate sales and lease transactions during the past six months depressed the overall activity in Maine’s real estate market, though residential activity and construction employment nudged up,...

Read ArticleMEREDA spring real estate index: Commercial declines; residential, construction strong

There are fewer sales, fewer leases and less square footage involved in Maine commercial real estate over the past six months, but residential and construction are going strong, according to...

Read ArticleMEREDA focuses on new approaches to housing at 2019 spring conference

The focus was on the future of housing in Maine, and new approaches to it, when several hundred real estate industry representatives gathered at the Maine Real Estate and Development...

Read ArticleSpring 2019 MEREDA Index Commentary – THE COMMERCIAL COMPONENT – Joseph Porta, Porta & Co.

Joseph Porta, SIOR, Broker/Manager of Porta & Co. recently provided insight for the Spring 2019 Edition of the MEREDA Index by sharing his perspective on the Commercial Sector over the...

Read ArticleSpring 2019 MEREDA Index Commentary – INTRODUCTION – Tim Soley, East Brown Cow Management, Inc.

Tim Soley, President of East Brown Cow Management, Inc. recently provided insight for the Spring 2019 Edition of the MEREDA Index by sharing his perspective on the markets overall. I’ve...

Read ArticleSix developers to be recognized by MEREDA

The top six real estate developments in Maine in 2018 have been selected by the Maine Real Estate and Development Association, the organization announced.

Read ArticleMEREDA is Proud to Host its 7th Annual “Strikes for Scholars” Fundraising Event at Bayside Bowl in Portland on May 23

MEREDA is proud to host its 7th Annual “Strikes for Scholars” Fundraising Event at Bayside Bowl in Portland on May 23, 2019. “Strikes for Scholars” supports scholarships for Maine students pursuing studies in building trades,...

Read ArticleMills appoints Hannah Pingree as innovation director, urges Mainers to ‘take the long view’

Gov. Janet Mills moved Thursday on one of the first changes she promised as governor with the appointment of Hannah Pingree, former speaker of the Maine House of Representatives, to...

Read ArticleHow to navigate the coming ups and downs in the economy

Investors and retirees worried about the volatility in the stock market might take heart that economic indicators show a generally positive economy nationwide in 2019, with some notable exceptions.

Read ArticleBooming real estate market makes housing for visa workers too expensive

One in two jobs in Maine is in hospitality, but hotels are finding it increasingly difficult to find staff because visa workers, which make up 10 percent of the workforce...

Read ArticleReal estate development was strong, but not crazy, in 2018

Development in southern Maine continues to be strong, although somewhat tempered compared with the last two years. That was the takeaway from a daylong conference for real estate and development...

Read ArticleMaine real estate market strong, but slowing

A report released on Thursday finds that Maine’s real estate market remains strong but is showing signs of slowing.

Read ArticleMEREDA forecast: Modest growth expected, but concern over what’s ahead for the economy

The Maine Real Estate and Development Association’s annual outlook conference attracted more than 1,000 people on Thursday. Coming off a particularly strong year, the forecast in various sectors was cautiously...

Read ArticleMEREDA Board of Directors votes to join the No on 1 campaign organized to defeat the referendum

This fall, Maine voters will face yet another ill-conceived citizen-initiated referendum that would establish a new tax to fund a home health care initiative. The proposed referendum would: * Impose...

Read ArticleMEREDA Index: Real estate activity reaches record in first quarter

The MEREDA Index, a quarterly measure of real estate activity in Maine, reached a new record through the first quarter of 2018, driven primarily by rising prices in the residential...

Read ArticleMPBN Maine Calling – Real Estate in Maine

Real estate is Maine’s number two driver of GDP (behind only healthcare). Maine has one of the highest home ownership rates in the nation. But many of those homes are energy-inefficient,...

Read ArticleDevelopments around waterfront, downtown buoy Bangor real estate market

The Greater Bangor market for industrial, office and retail real estate is growing at a stable pace, with some exceptions. Vacancies at the Bangor Mall, Kmart, the former Verizon call...

Read ArticleBrunswick Landing drives midcoast real estate activity

In 2017, Brunswick Landing continues to show strong growth in the Bath-Brunswick-Topsham region. The former Navy base houses 100 businesses that have created 1,500-plus jobs. More than 1 million square...

Read ArticleNIMBY vs. YIMBY debate continues to guide development

Maine’s real estate industry continues to look for ways to turn NIMBY into YIMBY — “not in my back yard” to “yes in my back yard” — as it continues...

Read ArticleMEREDA conference highlights demand, but lack of inventory

Vacancy rates are at or near historic lows in some areas, but the rents landlords are charging do not yet justify the cost of new construction. That’s one of the...

Read ArticleMEREDA Index: State’s real estate activity hits 10-year high

The MEREDA Index, a quarterly measure of real estate activity in Maine, hit a 10-year peak through the third quarter of 2017, reaching 96 overall in a composite measurement covering...

Read ArticleSouthern Maine’s real estate market still riding high, experts say

Southern Maine’s real estate market is riding high on the strength of rising home values, booming tourism, a tight market for industrial properties and renewed interest in office construction. That was the...

Read Article