Maximizing energy tax credits for RE developers

By Anita S. Mahamed, Dannielle Lewis, Teri Samples | Partners at Wipfli

The real estate industry can greatly benefit from energy tax credits and the changes made in the Inflation Reduction Act. As sustainability and environmental responsibility become increasingly important priorities, incorporating energy-efficient features into real estate projects not only reduces operating costs but also enhances the property’s value by helping the project stay green.

These recommendations can help real estate developers take advantage of energy tax credits to maximize their returns while contributing to a greener future.

Integrate renewable energy systems

Incorporating renewable energy systems into real estate projects is a great way to leverage energy tax credits. Installations such as solar panels, geothermal heating and cooling systems, wind turbines and energy storage solutions can qualify for significant tax credits. By integrating these systems, developers and real estate owners can reduce utility costs and generate additional revenue through excess energy production.

Additionally, they may be able to sell the tax credits to provide additional equity for their deals. But the requirements for obtaining the credit are complex.

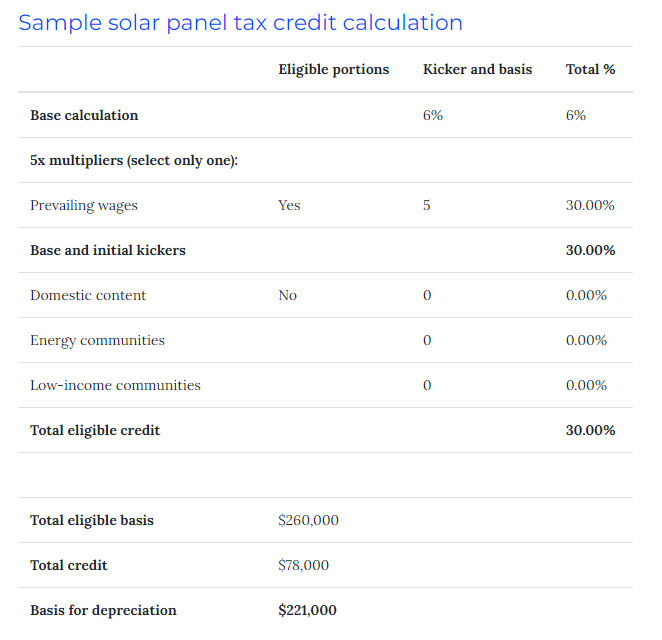

Here is an example of how the credit is calculated: A taxpayer develops a building and has solar units installed on the roof. The cost of the solar panels is $260,000. The solar panels were installed to meet the prevailing wage and apprenticeship requirements. In this situation, the taxpayer will be eligible for a $78,000 tax credit and the solar panels basis that is eligible for bonus depreciation is $221,000.

Explore energy-efficient upgrades and retrofits

Designing energy-efficient buildings can allow for substantial tax benefits. Energy tax credits are available for structures that meet certain energy performance standards and use energy-efficient technologies. Developers should focus on optimizing insulation, lighting systems, HVAC and building envelope components to enhance energy efficiency. By implementing energy modeling and using high-efficiency materials and systems, developers can qualify for tax incentives.

The incentives aren’t limited to new construction. Real estate developers can take advantage of energy tax credits through retrofits and upgrades. Upgrading existing buildings with energy-efficient windows, lighting, HVAC systems and insulation can make them eligible for tax credits.

These particular improvements may allow developers and real estate owners to take advantage of either a Sec. 179D tax deduction or a Sec. 45L credit. As an example, in July 2023, a developer created a new, four-story, 208-unit apartment complex. During 2023, it reached full occupancy and the property leased each unit. The apartment building also qualified for the federal Zero Energy Ready Home program and met the prevailing wage requirements. This means that they are eligible for a Sec. 45L credit of $5,000 per unit, equaling a total of $1,040,000.

How Wipfli can help

Navigating the energy tax credits may require the assistance of tax professionals and sustainability consultants. Wipfli advisors can provide guidance on eligibility criteria, documentation requirements and optimal strategies to maximize tax benefits. We can also help with energy modeling, project certification and ensuring compliance with applicable regulations. Most importantly, we can help you determine the best use of your equity for your deal before you spend it, bringing our specialized tax knowledge to help guide your decision-making to support your business through changing environmental policies.

Learn more about our tax services supporting the construction and real estate industries.

Sign up to receive additional tax and legislative content in your inbox.

Original article posted on June 8, 2023: https://www.wipfli.com/insights/articles/cre-real-estate-developers-take-advantage-of-energy-tax-credits