Signs of a Stabilizing Rental Market

By: Ben Sprague, Senior Vice President/Commercial Lender, First National Bank

After several frustrating years of frenzied activity, there are signs the rental market is stabilizing. To be sure, rents are much higher than they were five years ago, and hundreds of thousands if not millions of American renters are still dealing with limited options and lack of affordability. To them, these words may not bring much peace of mind. Yet there are clear indications that a plateau is upon us, or at least an easing of the pressure valve and perhaps a return to some sort of rational predictability in the rental market.

Rent Prices

Indication #1 is that rents have leveled off nationwide, and are even dropping in some markets. This comes after a surge in rents from 2021 to 2023. In fact, over the course of those three years, rents rose by 4.2%, 8.3%, and 6.5%, respectively, which means that a typical $1,200/month rent at the beginning of 2021 would have risen to $1,442/month by the end of 2023, a total increase of 20%.

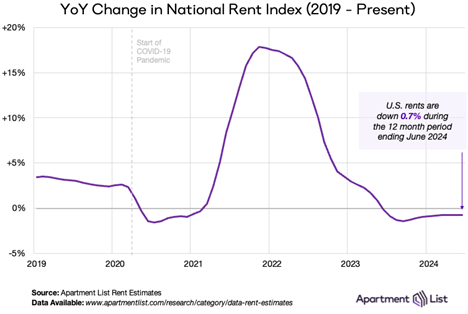

But now, according to the the July Apartment List National Rent Report, rents nationwide are actually down 0.70%, as illustrated in the chart below.

Source: July Apartment List National Rent Report

The decline of 0.7% is all the more notable in that this past week’s CPI report showed overall inflation still running at 3.0%, so in an inflation-adjusted basis rents are actually down by 3.7% year-over-year.

It is important to remember that there are notable regional variations in this data. Some of the steepest declines in rents have been in areas of the country that saw rapid growth during the pandemic such as Austin (rents down -7.4% year-over-year, non-inflation-adjusted), Raleigh (-5.2%), and Jacksonville (-4.1%). Rents in the Northeast have held up better. Per the report, “Most of the major markets in Florida, Texas, Arizona, and along the West Coast are currently logging negative year-over-year growth. In contrast, most large cities in the Midwest and Northeast are still experiencing positive annual rent growth.”

Per the Apartment List report, rents are down year-over-year in 80 of the top 100 metro areas around the country. Where are rents rising the most? There are just three metro areas around the country where rents are up more than 5.0% year over year: Honolulu, Louisville, and Hartford. I don’t think I could tell you what the common thread is between these three geographically far-flung communities, other than than perhaps not enough construction of new units in each of them to keep up with demand.

Vacancy Rates

A second indication of a normalizing rental market is that vacancy rates are ticking up, albeit modestly for now. Per data from the Federal Reserve, historical apartment vacancy rates have been in the 7.0-9.0% range. I can tell you as a quick aside, when my own bank underwrites a deal for a rental property acquisition or construction of new rental units, we typically assume 10% vacancy, which is particularly conservative, but it is what we use as we would rather underwrite them more conservatively than not.

Vacancy rates troughed out as low as 5.0% in the early 1980s and were as low as 5.6% as recently as the second quarter of 2022, but ticked up to 6.6% in the first quarter of 2024 per Federal Reserve data, which is the most recent quarter for which official data is available; ApartmentList.com says the vacancy rate is now up to 6.7%. The rise from 2022 lows is not anything to be alarmed about for now (at least from the perspective of a property owner/investor), but is a key data point suggesting we are on a path towards normalization in the rental market. Given all of the new construction of rental units over the past two years that have recently come online or will do so between now and the end of the year, it is likely that vacancy rates will continue to climb into the 7.0-7.5% range nationwide by early 2025.

Interestingly enough, just as the trajectory of rents has varied by geography, so too have vacancy rates. There are two states that share the lowest vacancy rates in the country at just 2.1%: Delaware and Maine. There are three states with vacancy rates above 10%: Florida, South Carolina, and Indiana, this according to data from the U.S. Census Bureau.

I know a lot of my readers are from Maine, as am I. In 2019, just prior to the pandemic, the apartment vacancy rate here in the Pine Tree State was 6.1%. The drop to 2.9% in five years shows just how tight the rental market has become. I attribute this to an influx of new residents during the pandemic, a fairly significant number of rental properties being converted to vacation rentals thereby removing apartment supply from the market, and underbuilding for much of the last decade. The state’s older demographics and limited workforce also contribute to a slower pace of construction that is needed to meet demand.

What Comes Next

Rents are likely to come down nationwide in markets that have seen the most new construction of units, which reflects a basic economic principle of supply and demand. Consider Austin, Texas, for example, which I wrote about a couple of months ago. According to John Burns Research and Consulting, the Texas capital was the #4 top community nationwide in new total apartment supply in 2023 with 17,025 new rental units completed and a whopping 42,986 new units newly under construction as of the end of the year. It is perhaps no surprise that in 2023 amid all this new construction, the average rent in Austin actually declined $105/month from $1,544/month to $1,439/month. This was one of the hottest communities in the country during the pandemic years, and now rents there are falling.

Softening (if not outright dropping) rents are good news for tenants and something that rental property investors should be mindful of. It was not out of the ordinary a few years ago for investors when penciling in a potential deal to factor in rent growth of 5-10% year almost indefinitely. Those numbers have held up here in the Northeast over the last few years, but there is also a lot of new construction of units happening now in this part of the country as well, which will likely lead to the same plateauing of rents that is currently being seen in other places. That doesn’t mean that investing in rental properties is not still viable, but it does tighten the math a bit, particularly over the long-term. The real challenges for rental property owners will come if the economy swoons and tenants start struggling to pay their rent. Rising wages and a robust labor market have provided a solid base of support for landlords and property owners in recent years, which hopefully will continue. The Federal Reserve’s efforts to rein in inflation will almost surely hit the labor market at some point, however, and weakness there could manifest itself as weakness in the rental market too. Time will tell.

Ben Sprague is a Senior Vice President/Commercial Lender at First National Bank. He writes regularly at bensprague.substack.com

Original article published on July 14, 2024 and located at https://bensprague.substack.com/p/signs-of-a-stabilizing-rental-market?utm_source=substack&utm_medium=email&utm_content=share