Greater Portland Vacancy Rate & Cap Rate By Year

By: Sam LeGeyt, SIOR, Partner | Broker, The Dunham Group

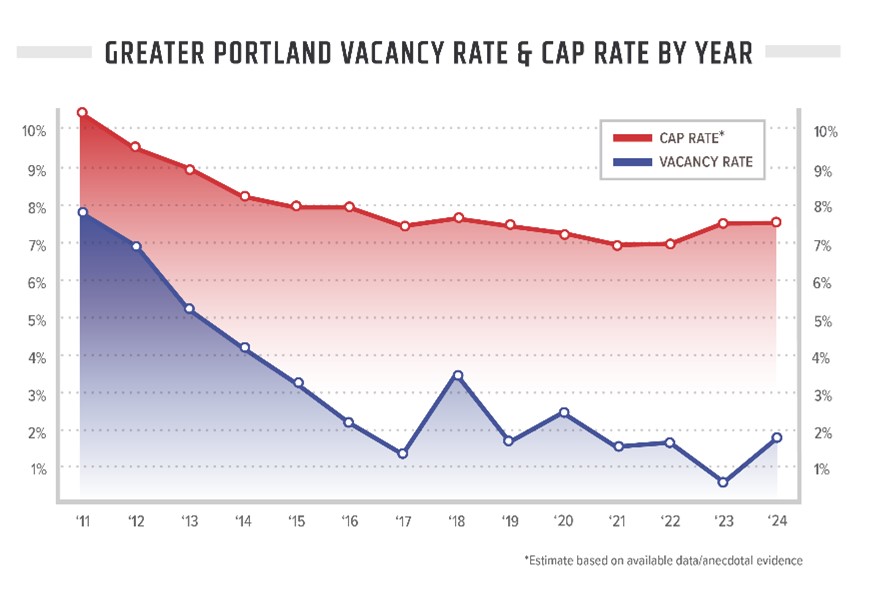

Vacancy Rates

It’s astonishing that we have gotten to a place where 100 basis points of vacancy feels like breathing room, but that is what ten years of sub 4% vacancy will do to a market. This year’s Southern Maine Industrial Market overall vacancy is 2.49%. Here’s how that breaks down regionally:

Greater Portland saw an increase in vacancy this year (yes you read that right) up to 1.96% – over 120 basis points. Although we had a higher vacancy rate this year, tenants and landlords are experiencing a similar arena; a supply and demand imbalance continually favoring landlords.

Tenants currently looking in the Cumberland, Falmouth, Freeport, and Yarmouth markets are all currently in a holding pattern or looking for off-market opportunities, as these submarkets have no available properties. Scarborough and Westbrook each offer 0.2% vacancy with less than 12,000 SF available across three properties. Portland (2.9%) and South Portland (4.5%) have slightly more to offer than their counterparts. However, it’s notable that seven of the fourteen available buildings offer over 20,000 SF, and we have seen a softening demand this year from tenants that large.

York County also saw an increase, albeit much smaller, approximately twenty basis points up to 1.79%. Saco absorbed the three vacancies from last year’s report and any vacancies created throughout the year, ending 2024 with 0.0% vacancy, as did Kennebunk. 69,634 SF remains available in Biddeford, across only three properties, one of which spans 52,000 SF alone at 20 Morin Street. We are excited to add Sanford and Wells to our report this year. But with only 50,000 SF available in Sanford (4.3%) and a 44,000 SF sublease opportunity in Wells, the tight market clearly extends well into York County. vacancy rates 4

Lewiston/Auburn was the only submarket in our report to see a decrease this year, down almost 200 basis points to 4.02%. While healthier than Greater Portland and York County, this is still far less than the national average around 6.5%. There are more of the same themes in this submarket as Auburn has only four total properties currently for lease, three of which are over 40,000 SF. Lewiston (4.3%) has six properties on the market, four between 30,000 – 65,000 SF. Gray remains very tight with 0.0% vacancy across our smallest tracked market of approximately 250,000 SF. This appears to be a great development opportunity if appropriate land can be sourced.

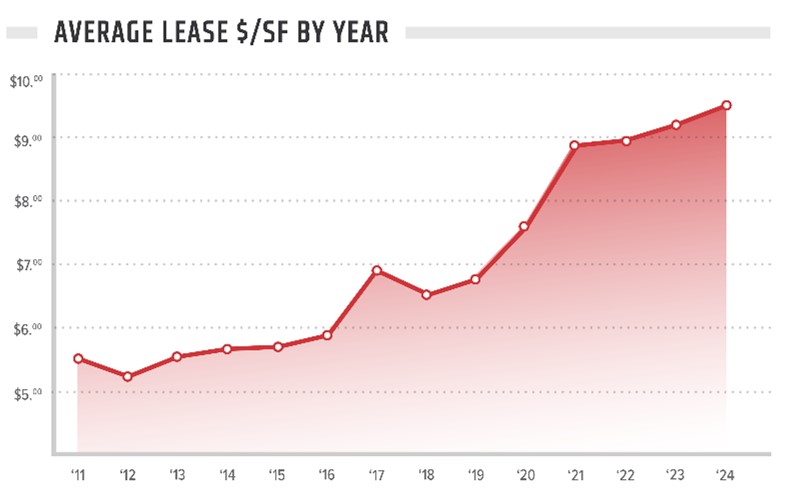

Lease Rates

Average asking lease rates rose slightly this year to $9.45/SF. As tenants flee to newer-quality buildings, asking rental rates continue to rise. I believe this number would be higher this year if it were not for the majority of available spaces being in square footages over 20,000 SF, which typically demand lower $/SF pricing.

Well located spaces are regularly coming to market between $10.00 – $15.00/SF NNN depending on the age, size and quality. New construction offerings are skewing the higher end of the range to justify high construction and capital costs. Businesses seeking modern facilities with higher ceiling heights, bigger doors, more loading docks, and more efficient layouts are now willing to pay a premium rate for these features that allow their business to run more successfully.

Although vacancy rates are slightly up, the historically high occupancy levels continue to put upward pressure on rents, enabling landlords to achieve higher pricing without concessions. Prices are likely to remain high and even increase due to tenant demand for newer buildings. That being said we, don’t know where the ceiling is. How much higher can rents go before tenants start to push back and explore other markets or solutions?

Given that we do not expect to see decreases in rental rates in the near future, one strategy businesses may benefit from are longer term leases to lock in current rates mitigating future increases.

Original article published February 2025, https://www.dunham-group.com/uploads/2025-southern-maine-industrial-market-survey_reduced.pdf