Aug 5, 2025 | Article, Blog, Maine Real Estate Insider, Member Articles

By Stephanie Brock – VP + GM Red Thread Maine Over the past year, the buzz around AI has moved from a whisper to a roar. In real estate, design, and workplace strategy circles, we’re now hearing about AI tools that can generate layouts in seconds, write marketing...

Aug 13, 2024 | Article, Maine Real Estate Insider

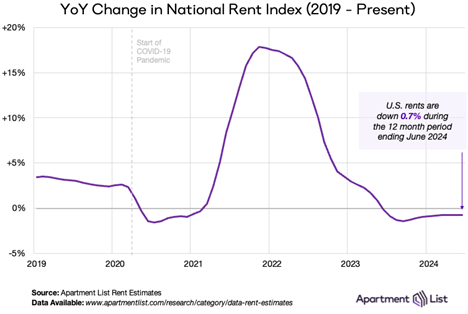

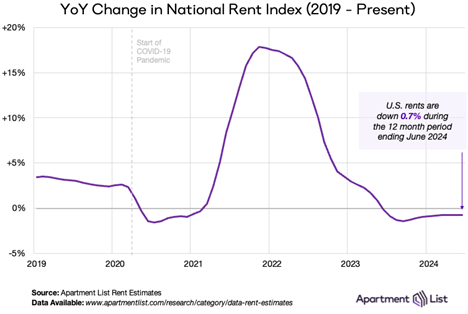

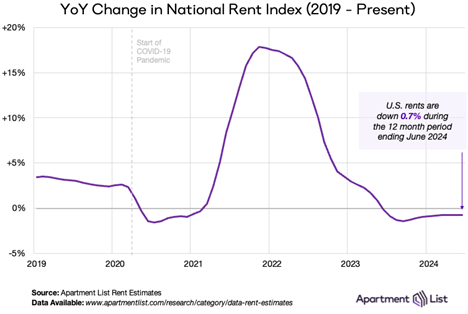

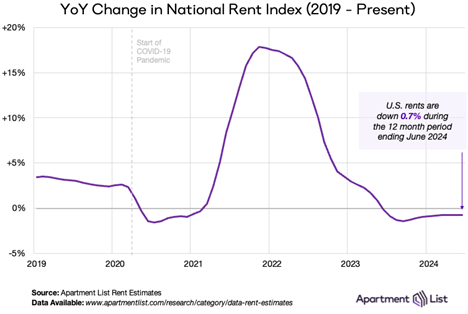

By: Ben Sprague, Senior Vice President/Commercial Lender, First National Bank After several frustrating years of frenzied activity, there are signs the rental market is stabilizing. To be sure, rents are much higher than they were five years ago, and hundreds of...

Oct 20, 2023 | Article, MEREDA News

Deadline Extended! Each year, MEREDA identifies and recognizes the most noteworthy and significant Maine commercial development projects from the previous year, all of which embody MEREDA’s belief in responsible development. Nominations are still being accepted...

Jul 25, 2023 | Article, Articles & Editorials, Maine Real Estate Insider

By Anita S. Mahamed, Dannielle Lewis, Teri Samples | Partners at Wipfli The real estate industry can greatly benefit from energy tax credits and the changes made in the Inflation Reduction Act. As sustainability and environmental responsibility become increasingly...

Jun 27, 2023 | Article, Articles & Editorials, Maine Real Estate Insider

By John Finegan | Associate Broker, The Boulos Company Like many states across the country, Maine has a housing crisis. The ripple effects of COVID and the needs of asylum seekers have created an influx of people coming to Maine. Simultaneously, the average number of...

Jan 15, 2020 | Article, Articles & Editorials

Maine, like the nation, has now seen economic growth that’s gone on unbroken for over a decade. That growth has been reflected in real estate development around the state. Will it continue? The question will be explored Thursday at an annual conference of the...